SG Options Trading Journal

Calendar spreads

Also known as horizontal spread or time spread.

These trade work bet on stocks or ETFs whose price moves within a reasonably narrow range.

Volatile stocks that can move up or down 15 percent within the time frame of one month are generally not suitable for calendar spreads.

3 major elements that characterize a good vertical credit spread

- Extra premium has been pumped into the price of the option being sold.

- The underlying stock price needs little or no movement to achieve maximum profit.

- 1 and 2 can be realized using front-month options.

Look for an event that produces a major move in the price of stock price accompanied by exceptionally high volume. This can be a move up or down in price.

Most importantly, the cause for this major move must be a event that is essentially concluded after the news is out. We want to see a dramatic move in the stock price followed by a relatively short period of time in which the stock price stabilizes or slightly reverses the big move.

This kind of situation pumps lots of extra value into the front-month options as traders scramble to cover existing positions or attempt to ride the momentum wave in the hope that a second burst will follow.

The aim is to place the short leg of the spread near the extreme price attained during the dramatic move. This may require careful observation for a few days in case there is another surge that needs to exhaust itself.

Credit Spreads

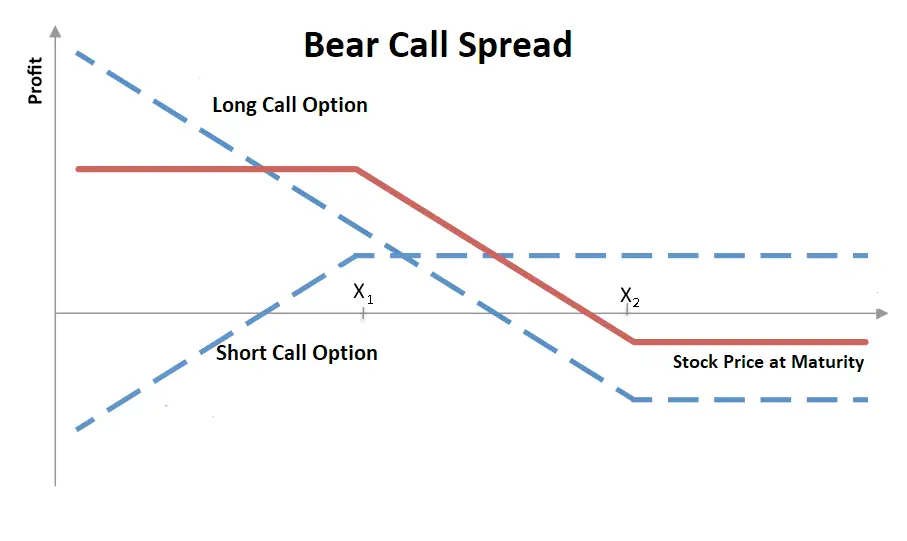

The bull put spread and the bear call spread are credit spreads.

These trades bring money into your account, which ultimately becomes a profit if the stock price reaches or exceeds the targeted level at expiration. These trades are typically short-term trades that seek to capture the credit as soon as reasonably possible.

The maximum profit is the amount of the credit spread.

To get a suitable risk to reward ratio in a weekly vertical spread, it is often necessary to do a credit spread with the short leg strike being in-the-money. This means that the price of the underlying stock or ETF will need to move rather quickly in a favorable manner in order to achieve the maximum profit. The possible of such a price move within the brief lifetime of the option needs to be weighed against the profit potential of the spread.

Debit Spreads

The bull call spread and the bear put spread are debit spreads.

For these trades to pay off, the stock needs to have enough time to move to the targeted level.

For this reason, you want to use options with expiration dates that allow enough time for this move to occur.

To achieve the maximum profit, the stock price needs to have reached or exceeded the strike price of the short option at expiration. The maximum possible profit is always the difference between the strike prices of the long and short options less the original cost of the spread.

Bear and Bull Spreads

Bear spread

A bear spread can be set up using:

Calls:

- 1 short call with a lower strike price.

- 1 long call with a higher strike price.

Puts:

- 1 short put with a lower strike price..

- 1 long put with a higher strike price.

Bull spread

A bull spread can be set up using:

Calls:

- 1 long call with a lower strike price.

- 1 short call with a higher strike price.

:max_bytes(150000):strip_icc()/BullPutSpread-56a6d2315f9b58b7d0e4f791.png)

Puts

- 1 long put with a lower strike price.

- 1 short put with a higher strike price.

Iron Condor

The iron condor option strategy is a risk-defined, neutral options trading strategy that benefits from premium decay and minor up or down moves in the underlying asset.

Essentially, an iron condor is a call credit spread combined with a put credit spread that, when executed properly, produces a trade with a net delta of around zero.

Reverse Iron Condor

Reverse iron condors are similar to long strangles in objective: they depend on large directional moves and increased volatility.

However, reverse iron condors are less expensive than a long strangle because short options are sold above the long call and below the long put.

This lowers the total amount paid to enter the trade but will limit the profit potential to the width of the spread minus the initial debit paid.

Implied volatility impact on a Reverse Iron Condor

Reverse iron condors benefit from an increase in the value of implied volatility.

Higher implied volatility results in higher option premium prices.

Ideally, when a reverse iron condor is initiated, implied volatility is lower than where it will be at exit or expiration.

Future volatility, or Vega, is uncertain and unpredictable.

Still, it is good to know how volatility will affect the reverse iron condor strategy’s pricing.

A simulated trade: a bullish trade

The following is a theoretical trade on AAPL options.

Suppose we enter into a bull spread with a strike price of 167.50 and 170 when the stock price is 151.03. We expect the stock prices to move up and investigate the value of the stock options.

| Trade date | 6 Mar 2023 |

| Stock price | 151.03 |

| Strategy | Bull spread |

| Expiration date | 17 Mar 2023 |

| Strike prices | 167.5, 170 |

Market snapshot

| Option | Expiration | Strike price | Bid | Ask |

| Put | 17 Mar 2023 | 167.5 | 15.35 | 18.15 |

| Put | 17 Mar 2023 | 170 | 17.85 | 21.00 |

| Call | 17 Mar 2023 | 167.5 | 0.04 | 0.05 |

| Call | 17 Mar 2023 | 170 | 0.03 | 0.04 |

Strategies

We purchase a bull spread using puts by selling the 167.5 put and buying the 170 put.

Sell P167.5@15.35

Buy P170@21

Net = 15.35-21=-5.65. This will result in a net debit of $5.65 in our account.

We purchase a bull spread using calls by selling the 167.5 call and buying the 170 call.

Sell C167.5@0.04

Buy C170@0.03

Net = 0.04-0.03 = 0.01. This will result in a net credit of 0.01 in our account.

5 days later

Suppose the date and time now is 10 Mar 2023 at 03.15am SGT. The stock price is 152. The option prices looks like this:

| Option | Expiration | Strike price | Bid | Ask |

| Put | 17 Mar 2023 | 167.5 | 15.50 | 15.75 |

| Put | 17 Mar 2023 | 170 | 18.05 | 18.25 |

| Call | 17 Mar 2023 | 167.5 | 0.04 | 0.05 |

| Call | 17 Mar 2023 | 170 | 0.02 | 0.03 |

The market value of our bull spread using puts is:

Buy P167.5 @ 15.75

Sell P170 @ 18.50

Market value = 18.5-15.75 = 2.75

The market value of our bull spread using calls is:

Buy C167.5 @ 0.05

Sell C170 @ 0.02

Market value = 0.02 – 0.05 = -0.03

The payoff of our strategy is then:

Using puts = 2.75 – 5.65 = -2.9

Using calls = -0.03 – 0.01 = -0.04

Conclusion

A bull spread using calls when there is a small increase in stock price yields better results.

Welcome to SG Options Trader

Hello! This is my trading Journal.

Markets I think of trading:

- Options (US markets)

- FX

- Futures