Bear spread

A bear spread can be set up using:

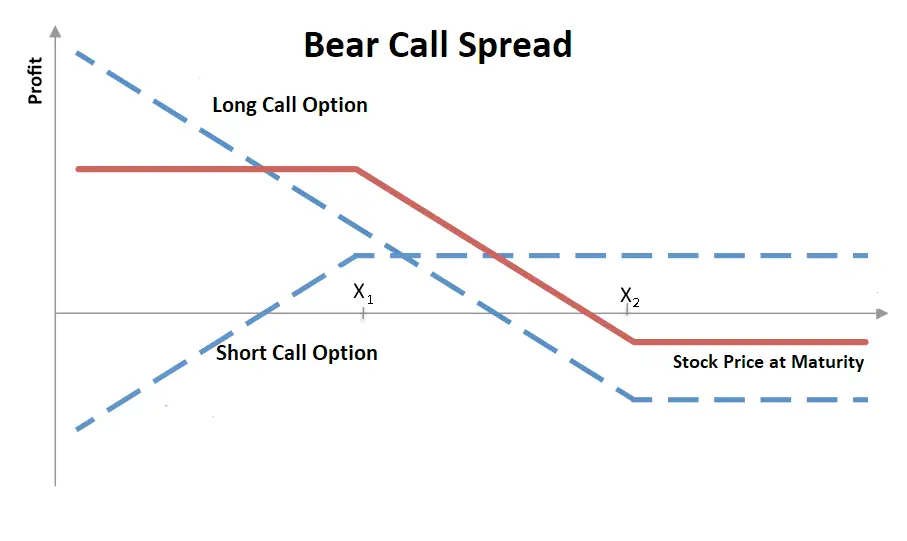

Calls:

- 1 short call with a lower strike price.

- 1 long call with a higher strike price.

Puts:

- 1 short put with a lower strike price..

- 1 long put with a higher strike price.

Bull spread

A bull spread can be set up using:

Calls:

- 1 long call with a lower strike price.

- 1 short call with a higher strike price.

:max_bytes(150000):strip_icc()/BullPutSpread-56a6d2315f9b58b7d0e4f791.png)

Puts

- 1 long put with a lower strike price.

- 1 short put with a higher strike price.

Iron Condor

The iron condor option strategy is a risk-defined, neutral options trading strategy that benefits from premium decay and minor up or down moves in the underlying asset.

Essentially, an iron condor is a call credit spread combined with a put credit spread that, when executed properly, produces a trade with a net delta of around zero.

Reverse Iron Condor

Reverse iron condors are similar to long strangles in objective: they depend on large directional moves and increased volatility.

However, reverse iron condors are less expensive than a long strangle because short options are sold above the long call and below the long put.

This lowers the total amount paid to enter the trade but will limit the profit potential to the width of the spread minus the initial debit paid.

Implied volatility impact on a Reverse Iron Condor

Reverse iron condors benefit from an increase in the value of implied volatility.

Higher implied volatility results in higher option premium prices.

Ideally, when a reverse iron condor is initiated, implied volatility is lower than where it will be at exit or expiration.

Future volatility, or Vega, is uncertain and unpredictable.

Still, it is good to know how volatility will affect the reverse iron condor strategy’s pricing.